Who Pays For Medicare: The Basics

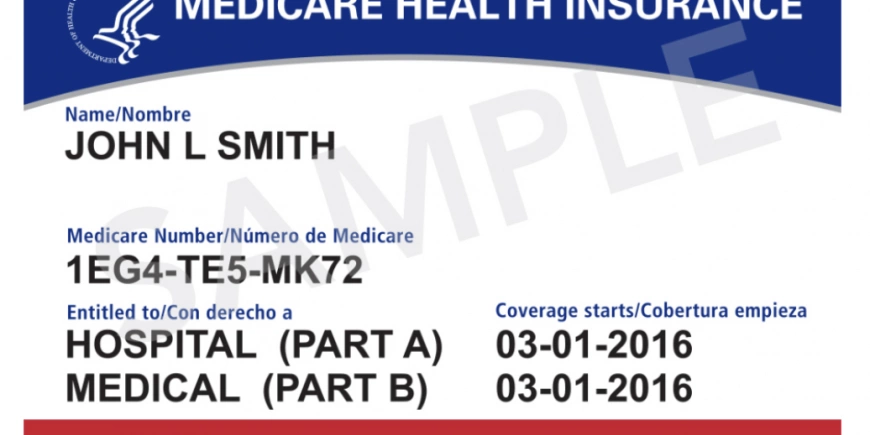

Many do not understand Medicare, let alone how it is paid for. Most people only know that when they turn 65 or retire from their job, they switch to Medicare and all those taxes they paid during all those years will ensure they receive their Medicare. Well, sort of. So, who pays for Medicare? It's not that simple, but here are thye basics.

Deductions From Your Paycheck

The Federal deductions from your paycheck are Federal, Social Security, and Medicare withholdings. Federal withholding is a tax and is based on your income tax bracket, Social Security withholding is for Social Security benefits and we will not address those here. The third is Medicare, part of what is known as FICA (Federal Insurance Contributions Act). The Social Security and Medicare withholdings are called taxes but some do not consider them a tax, they consider them payments towards benefits to be received later. Either way, if you work you pay 1.45% of your earnings to the Medicare Trust Fund and your employer also pays 1.45%.

About The Medicare Trust Fund

There are actually two (2) Trust funds that make up the Medicare Trust fund. The first is the hospital insurance (HI) trust fund and that is where you and your employer's 1.45% (2.90% altogether) go, along with any taxes paid on Social Security benefits. The second is the Supplemental Medical Insurance (SMI) trust fund, whicjh is funded by general tax revenue and premiums enrollees pay.

The HI trust fund covers Part A of Medicare and the SMI trust fund covers Part B and D of Medicare.

What You Pay When You're On Medicare

All Medicare parts A, B, and D have costs associated with them; a premium, a deductible, and various co-pays or co-insurance. The services provided by Medicare can be found in the Medicare & You booklet issued each year.

Most Medicare recipients pay a $0 premium for their Part A Medicare insurance because they have worked long enough (10 years or 40 quarters) and paid into it from their paycheck withholding plus what their employers have paid. If you do not have enough quarters you pay a premium up to $458 per month. This coverage is for hospitals, skilled nursing, and hospice (plus a few others).

Part A Medicare has a deductible and co-pays which surprises many people. The hospital deductible is $1408 each time you use it when you have 60 days between services. Ouch! Most people know nothing about that Part A deductible. For skilled nursing, the first 20 days costs $0. After 60 days in a hospital, or 20 days in a skilled nursing facility, you are responsible for co-pays for each day of stay. Hospice care is typically covered at 100%.

A shock to many moving to Medicare is that you pay a premium for Part B. It changes periodically, right now it is roughly $150.00. Part B is elective, meaning you can choose to enroll or not. However, there are penalties if you do not enroll when you should, so beware. Part B covers medical procedures and physician services and more. The deductible with Part B is $198 and a 20% co-pay of the approved amount for medical services covered under Medicare. If there are excess charges beyond what Medicare covers, you pay those as well.

The latest addition to Medicare is Part D for prescription drug coverage. The shocker to many is that Part D is also elective and there are late penalties if you don't enroll at the right time. Many who are new to Medicare do not take prescription medications so they don't think they “need” a prescription drug plan. Again, these folks will pay a late enrollment penalty if they do not enroll in a plan when they are eligible. These Part D prescription drug plans are administered by private companies under the CMS (Centers for Medicare & Medicaid Services) guidelines. For participants, there is a premium, a deductible, and co-pays or co-insurance which vary depending on the plan.

Two other funding sources, LEP Late Enrollment Penalty, and IRMAA Income Related Monthly Adjustment Amounts. Late Enrollment Penalties we touched on already. You will pay an LEP if you do not enroll when you should. These penalties can be for specific periods or forever depending on part A, B, or D. IRMAA is an additional premium added onto your regular premium for high-income beneficiaries, this will remain in place as long as your income remains high.

So, back to our question, how is Medicare paid for? YOU and your employer. Medicare is funded by payroll withholding, employer contributions, and through premiums, deductibles, co-pays, co-insurance, and general tax revenues.