From Holidays to Headaches: Why Medical Bills Don’t Wait

What You’ll Learn in This Post

By the end of this post, you’ll know:

✅ Why medical bills don’t always match your Explanation of Benefits (EOB)—and what to do when amounts keep changing.

✅ How long insurance appeals really take (and why “30 days” often means much longer).

✅ How to stop the blame game by forcing three-way calls between vendors and insurers.

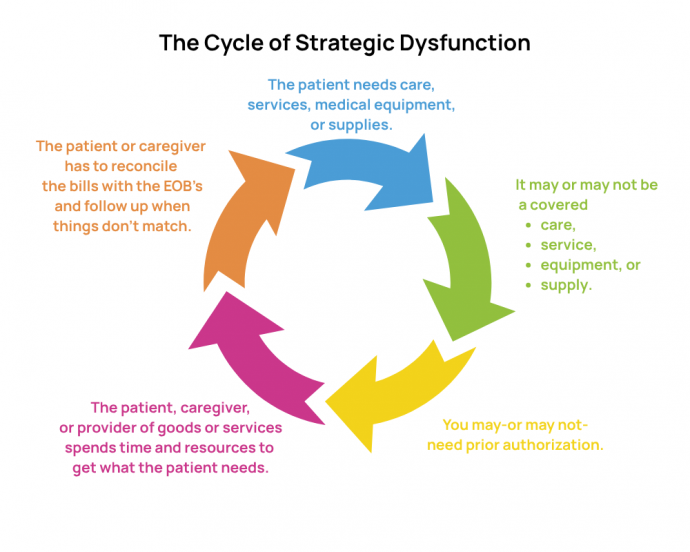

✅ What “strategic dysfunction” means—and how insurance companies use it to make you give up.

✅ Simple documentation strategies to protect yourself from billing errors and repeated denials.

The first bill for Durable Medical Equipment (DME) came in November. Then another. And another.

I didn’t panic. I’ve done this dance before. I know not to pay the first bill that shows up—especially because three things had to happen perfectly:

- The DME company had to be right about being in network.

- The DME company’s billing department had to bill the correct equipment.

- The insurance company’s payment system—running mostly on autopilot—had to remember what it told me back in September and pay the bills correctly.

The odds of all three of those things happening were not very high.

Medical Crises Don’t Happen in a Vacuum

I planned to handle the bills sooner, but the holidays hit. Medical crises don’t happen in a vacuum.

I was still working full time. My husband was home and required 30–40 hours per week of direct care, on top of everything else.

For anyone who hasn’t been a caregiver, that number might sound exaggerated. It’s not.

- ADLs (Activities of Daily Living)—basic care tasks like bathing, dressing, toileting, feeding, and transfers—can easily take 2–3 hours per day when someone is bed- or chair-bound.

- IADLs (Instrumental Activities of Daily Living)—things like cooking, cleaning, laundry, medication management, and scheduling medical appointments—add another 3–4 hours per day on average.

According to AARP, family caregivers providing high-intensity care can spend 20–40 hours a week or more doing exactly these tasks. I was living proof of that statistic.

So, I was scheduling doctor visits, keeping track of medications, helping him bathe, coordinating physical and occupational therapy—and still trying to pretend Christmas was “normal.”

The stack of bills sat in a drawer. Out of sight, but definitely not out of mind.

Reality Check

In the three months after discharge, we made it to our son’s wedding, I got laid off from work, and the holidays came upon us. Losing my job was stressful, but it had one upside—it stopped me from working like my hair was on fire every day.

Which meant I finally had no excuse. I had to make time to tackle the mountain of paperwork and medical bills.

I gave myself an entire day—no distractions except my patient—and started calling every provider, every facility, and the equipment company.

That’s when I re-learned something truly infuriating: every bill status and amount due had changed.

One provider’s bill had jumped. Another had dropped. The EOBs didn’t match the statements. Nothing lined up.

At that moment, I needed a spreadsheet, a bottle of Advil, and probably a therapist.

The Appeal Gauntlet Begins

The first time I called the DME provider, they hadn’t received any insurance payments yet—and they thought I was calling to pay the balance.

Nope. Not happening.

I laid it out clearly:

- We had a true high-deductible plan.

- We had already met both the deductible and out-of-pocket maximum.

- They should be talking to the insurance company, not me, about payment.

The billing department said they’d submit an appeal for the unpaid equipment. That sounded helpful—until I asked the obvious question:

“Can we do a three-way call with the insurance company?”

They hesitated. I didn’t.

“We’re doing it,” I said.

Because the fastest way to stop the blame game is to put everyone on the same call. To their credit, the insurance rep agreed. On that first three-way call, we actually made progress:

- The vendor needed to appeal.

- Some of the billing was incorrect.

- We had met our deductible and out-of-pocket maximum (although the rep couldn’t find the exact date when that happened), which meant most, if not all of the charges, should never have been sent to me.

It still felt big, messy, and expensive—and I knew this was only the beginning.

The Second Call: Getting Specific

I called one month later. Why one month? Because everything with insurance takes “at least 30 days”—their words, not mine. Once again, I initiated another three-way call.

This time, I came armed with dates, dollar amounts, EOBs, and questions.

The insurance rep told the DME companythe precise date when we met our out-of-pocket max. That one detail helped the vendor back off a few charges immediately and pivot to collecting their payments from the insurance company. No more statements for some pieces of equipment.

But the Hoyer lift? Still showing up. Still unpaid. Still $1,500.

The System Counts on You Quitting

This is where most caregivers get stuck.

You make the calls. You explain the situation. You follow their instructions. You take notes.

And still, the bills keep coming. The story keeps changing. The denials keep piling up.

Meanwhile, your life keeps chugging along. You don’t have time to stay in the battle, so you surrender. You stop fighting and just decide to pay the medical bill. In the industry, this is called “strategic dysfunction.” It’s built into the insurance company’s profit margins.

See, it’s not your fault. The system isn’t designed for patients and their families.

You’re not supposed to have the time, energy, or sheer stubbornness to keep pushing. They plan on you giving up.

Not me. Nope.

Truths from the Frontlines

From a Social-Worker-Turned-Caregiver-Turned-Healthcare-Advocate:

- Document. Document. Document. Write down every date, every name, every “we’ll follow up in 30 days.” Don’t trust your memory. Your brain is overloaded.

- Never assume the first person is right. Probably don’t assume the second or third are either.

- The system is designed to be dysfunctional, stressful, and expensive—in time and money. Knowing that ahead of time changes how you fight.

Why You Shouldn’t Fight Alone

If this feels overwhelming just reading it, imagine living it.

Caregivers aren’t failing when they can’t keep up with the bills, the appeals, and the endless phone calls—they are simply victims of the way the system is built.

I know, because I was doing everything “right,” and it still took months of persistence to make progress. Most caregivers don’t have that kind of time, energy, or insider knowledge—and they shouldn’t have to.

That’s why healthcare advocacy matters. Someone who knows the system, knows your rights, and isn’t emotionally and physically exhausted can take on this fight for you—or at least fight alongside you.

Because if you don’t keep pushing, the system wins.

And caregivers have enough to carry already!

Bio: Kim Ferth, BSW, is the owner of Healthcare Survival Kit. We hand families the roadmap the healthcare system never wanted you to have. We guide you step by step, help you avoid costly mistakes, and give you the support you need to make confident decisions—so you can worry less and focus on what matters most: your health and peace of mind. To learn more, visit the website at healthcaresurvivalkit.com or email Kim at kim@healthcaresurvivalkit.com.

Bio: